Portfolio weight calculator

Press the Clear button to clear the calculator. Contribute to youngf-GitHubPortfolio-Weight-Calculator development by creating an account on GitHub.

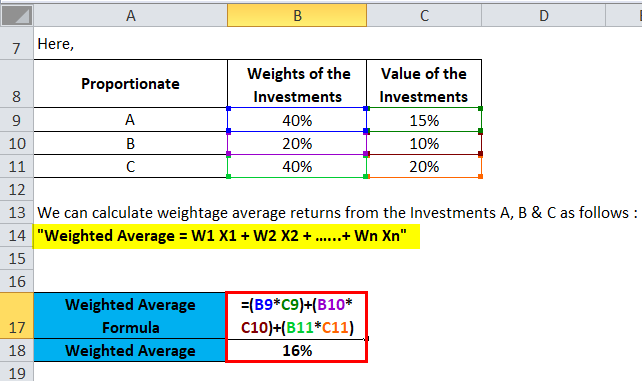

Weighted Average Formula Calculator Excel Template

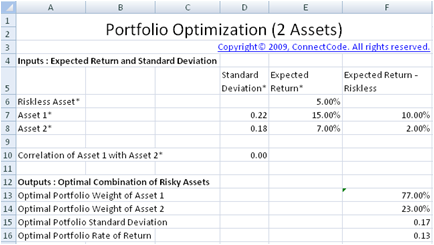

Asset 2 makes up 56 of a portfolio has an expected return.

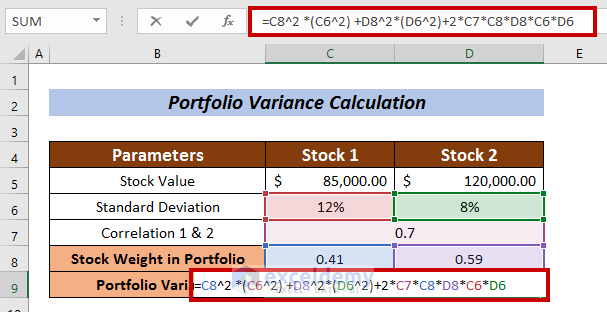

. Using the above formulas we then calculate the portfolio. Similarly we have calculated the weight for other particulars as well. We use historical returns and standard deviations of stocks bonds and cash.

Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. To find the weight of stock A we will divide 5000 by. Portfolio weights can be calculated using different approaches.

As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the. We want to calculate the weight of stock A. Contribute to govorunovweight_calculator development by creating an account on GitHub.

The starting value of your portfolio along with the starting. Portfolio asset weights and constraints are optional. Contribute to youngf-GitHubPortfolio-Weight-Calculator development by creating an account on GitHub.

We have three different funds in our portfolio each having a different expense ratio and a different fund position. To compute the portfolio weight of each investment repeat the calculation in successive cells dividing by the value in cell A2. If we add up all the stocks the total number of shares in a portfolio will be 8500 shares.

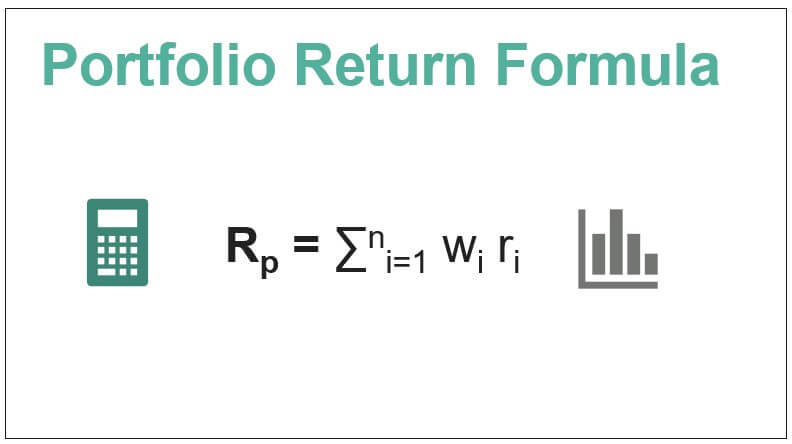

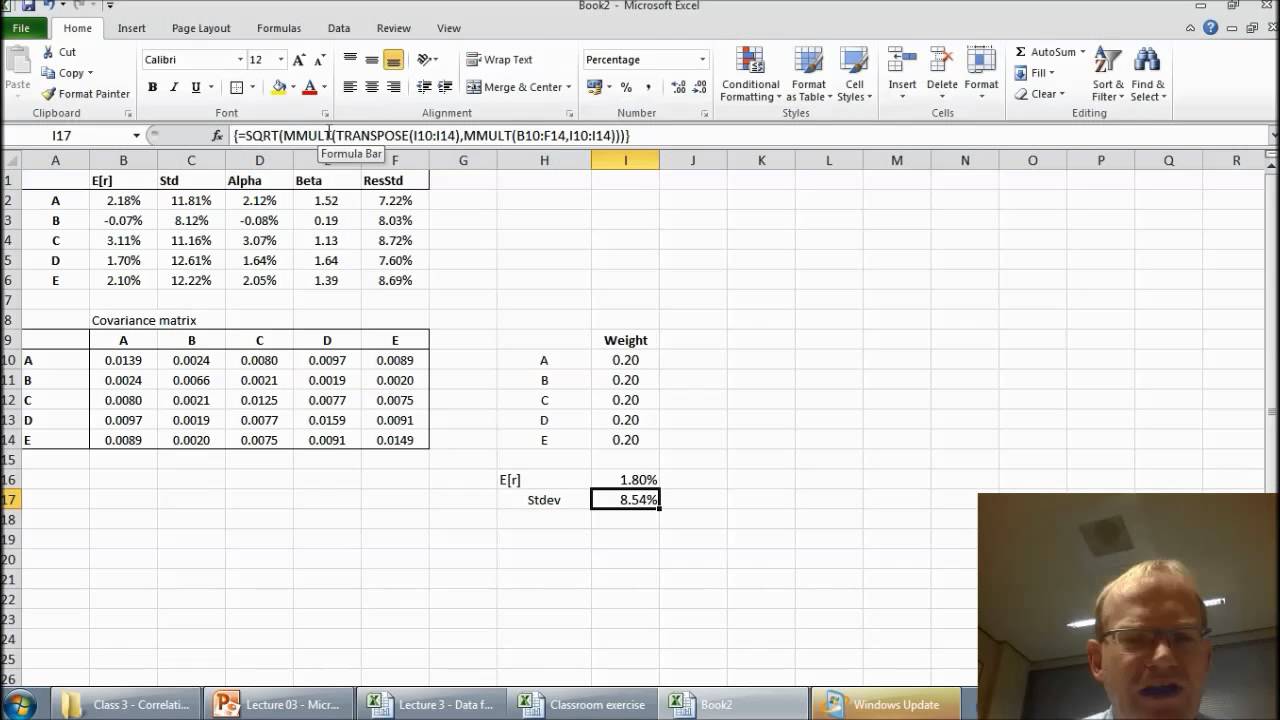

Now for the calculation of portfolio return we need to multiply. To construct a portfolio frontier we first assign values for ER 1 ER 2 stdevR 1 stdevR 2 and ρR 1 R 2. Armed with the above information you can calculate the.

We start with a brief beta definition in stock market context. Now that we have the return and weight of each investment we need to multiply these numbers. The most basic type.

You can also use the Black-Litterman model. Weight XYZ Stock 100000 620000 01613. Put the formula C2 A2 in cell E2.

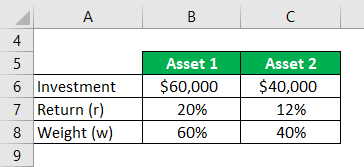

Using the money-weighted rate of return excel calculator is straightforward. Asset 1 makes up 44 of a portfolio and has an expected return mean of 19 and volatility standard deviation of 7. Portfolio weight is the percentage composition of a particular holding in a portfolio.

For real estate we will multiply 56 by 10 to get 56. The required inputs for the optimization include the time range and the portfolio assets. Contribute to ayaonbJavaPortfolioWeightCalculator development by creating an account on GitHub.

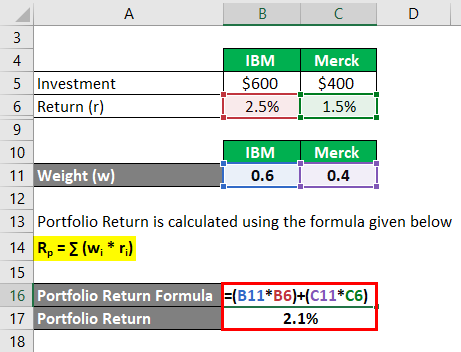

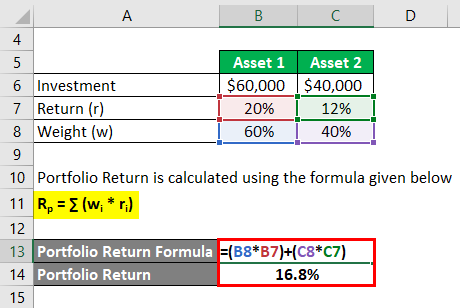

Consider an investor is planning to invest in three stocks which is. Portfolio Return 60 20 40 12 Portfolio Return 168 Portfolio Return Formula Example 2. Portfolio Returns - The Expected Return Variance and Standard Deviation for the portfolios formed from Stocks 1 and 2 are displayed.

Following this formula for stocks and. Heres what youll need to fill in.

How To Calculate Portfolio Variance In Excel 3 Smart Approaches

Free Portfolio Optimization

Portfolio Return Formula Calculator Examples With Excel Template

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Calculating A Sharpe Optimal Portfolio With Excel

2

Investments Portfolio Weights And Portfolio Optimization Cfajournal

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Beta Calculator

Calculating A Sharpe Optimal Portfolio With Excel

Portfolio Return Formula Calculate The Return Of Total Portfolio Example

Finance Problem Determining Portfolio Weights Youtube

Portfolio Return Formula Calculator Examples With Excel Template

Weighted Average Formula Calculator Excel Template

Portfolio Beta Calculator

Portfolio Return Formula Calculator Examples With Excel Template

Optimal Portfolios With Excel Solver Youtube